The Day After Project Macroeconomic Overview – Civil Services and Government Policy

- Yoni Ben Bassat and Amit Ben-Tzur

- 1 בדצמ׳ 2023

- זמן קריאה 7 דקות

עודכן: 13 באוג׳ 2025

Yoni Ben Bassat and Amit Ben-Tzur

Chief editor: Amit Ben-Tzur

Hebrew editing: Daphna Lev

English translation: Dr. Carly Golodets

Design: Adi Ramot

December 2023

The project was written in response to the revealed weaknesses of the government and public services during the October 7 War.

For the last 40 years, particularly since 2003, Israel has experienced a continued, intensifying reduction in the state’s responsibility towards its citizens. This reduction is evident in the gradual erosion of responsiveness to needs, ongoing under-budgeting of civil government expenditure and significant privatization processes. This reduction in responsibility has affected all areas of public services, including healthcare, education and welfare, among others. The consequences include a decline in the quality and availability of public services, increased disparities in access to these services, and a negative impact on the overall quality of life for everyone.

The Gap between Israel and the OECD Countries and Comparison Countries

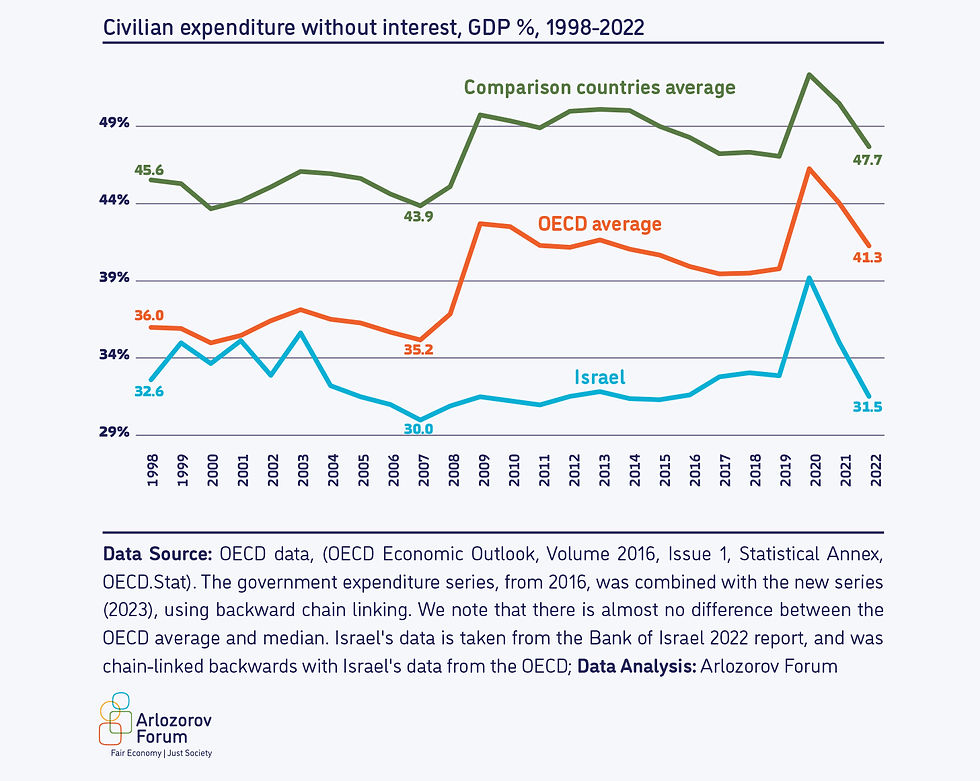

There is s significant gap in civil expenditure between Israel and the OECD countries (Figures 1 and 2)[1]. As of 2022, this gap stands at approximately 171 billion ILS[2].

With respect to the comparison countries[3] this gap stands at approximately 284 billion ILS. These great disparities are the outcome of policy measures initiated in 2003, since prior to this policy Israel was very close to the average of the OECD countries (Figure 1).

This long-term trend of reducing civil expenditure does not allow the State of Israel to provide basic services with adequate quality and availability during routine times. Similarly, under-budgeting prevents public agencies from conducting themselves more effectively and efficiently, as they do not have the means to develop advanced infrastructure capabilities. No less importantly, we can assume that this ongoing long-term reduction and subsequent cumulative gaps have a negative impact on the readiness and capabilities of the government during emergencies.

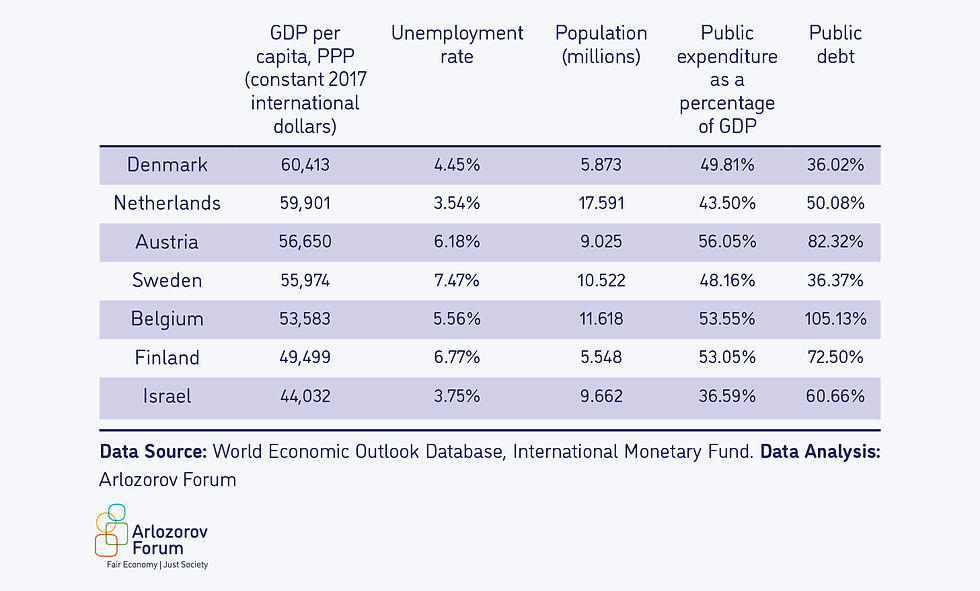

[1] The comparison countries are Austria, Belgium, Denmark, Finland, Netherlands and Sweden. Each one has a higher GDP per capita than Israel and a fairly similar population size to Israel. Government expenditure in these countries constitutes over 45% GDP, thus they serve as an example of strong, developed countries that manage a large, effective public sector. See Appendix A.

[2] Total government expenditure not including defense and interest payments.

[3] Israel’s GDP in 2002 was approximately 1,764 billion ILS. The gap between Israel and the OECD countries is approximately 9.8 GDP percent points. In 1998 this gap was only approximately 3.4 percent points.

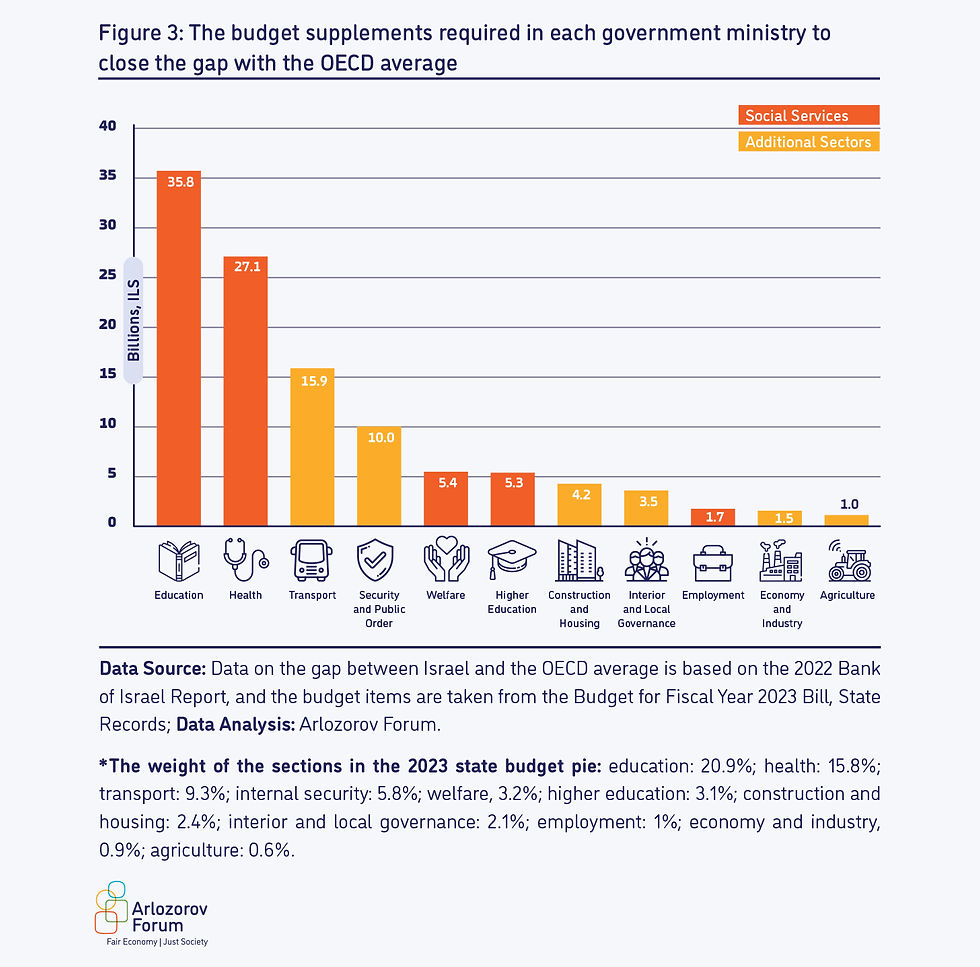

The Gaps in Civil Expenditure – Allocation by Sections

How should we allocate the additional enormous sum of 171 billion ILS that Israel needs to spend? There is no one correct answer. We have chosen to determine this using the existing allocation reflected by the state budget, meaning, the relative share of each section according to current priorities (which do not no change significantly over time) (Figure 3). Of course, this allocation does not express the optimal budget additions required for each section since the state budget does not necessarily reflect optimal priorities; however, in this way we obtain an estimate of the scale of budget supplement required for each of the different services (calculation details in Appendix B).

What needs to be done?

1. Gradually increase public expenditure through a multi-year plan, to reduce the gap with the OECD countries.

2. The increased expenditure will be expressed, first and foremost, by the addition of professional staff to welfare, education and healthcare, to provide services of the same high quality and availability that exist in other developed countries around the world.

Questions and Answers

1. Is this a new phenomenon? If not, why are you focusing on it now?

The great gaps in civil budgets between Israel and the OECD countries have been evident for many years; the war has simply exacerbated them. We stress that these budget gaps did not begin with the current government; rather, they are the result of a years-long policy with the declared, intentional aim of shrinking the public sector. Our aim is to illustrate how the annual debate over minor percentage increases in the budget, ongoing for decades, is a pointless discussion that does not get to the point. What is the point? A shrunken public sector with poor capabilities has a negative impact on citizens, the economy and the state.

2. Increasing expenditure by 171 billion ILS? The costs of the war are already estimated at approximately 100 billion ILS and we don’t have money for everything

We are not necessarily asking to increase the budget by 171 billion ILS. This number, just like the other numbers relevant to other fields, simply indicates the magnitude of the missing budget; a general estimate rather than a precise, final number. The great magnitude of the budget gap teaches us that the discussion on the required budget for different fields cannot remain within the regular framework of increasing the budget by a few percent. Likewise, since the system is experiencing ongoing serious under-budgeting, the marginal shekel has a very small effect at this stage. We require a budget supplement of significant magnitude to optimize the discussions on where to invest the marginal shekel, as part of the routine budget supplements.

3. Increasing expenditure by 171 billion ILS? Israel has significantly higher defense expenditure than the OECD countries

If we asses public expenditure, which besides civil expenditure also includes defense expenditure and interest on the national debt, the expenditure gap with the OECD is approximately 1.5 percentage points, equivalent to 90 billion ILS as of 2022. In other words, the huge gap in civil expenditure is not a result of defense expenditure and interest, since these expenses comprise approximately 50% of this gap. If civil expenditure equalized the OECD average (i.e., an extra 171 billion ILS), then public expenditure would be greater than the OECD average (48.9% in Israel compared to 44.2% in the OECD), but slightly lower than the average of the comparison countries (49.6%).

4. Increasing expenditure by 171 billion ILS? So that the money will go to more coalition agreements?

Our proposal to increase expenditure by this magnitude assumes that expenditure will be earmarked for growth-encouraging and gap-bridging services. This includes expenditure on education, vocational training, public housing and public transport (all in accordance with the Bank of Israel recommendations), as well as additional expenses – in healthcare, mental healthcare and welfare – which all aim to improve quality of life and avoid the need for high expenses to repair the damages that will accumulate without effective action.

5. Increasing now? We have a war to fund

Obviously, the budget cannot be increased immediately to the extent we propose. We believe that expenditure should be increased gradually, over several years, to optimize the use of the extra resources by government ministries and facilitate sustainable funding. These two components require time. It is clear beyond doubt that a basic plan must be built to put Israel on the road to increasing civil expenditure and improve the capabilities of the civil services.

6. Where will the money come from?

This paper does not deal with how to fund the expenditure, since that requires a much more in-depth discussion than we are presenting here. Moreover, several position papers offer possible directions for funding[1]. Our first task is to determine where we are going, and then plan how to get there.

[1] See: Kollerman, M (2022). A Budget for Economic Growth. Yesodot Institute [Hebrew]; Kollerman, M (2020). The Expansion Program. Yesodot Institute [Hebrew]; Ofek-Shani, Y (2020). Where Is the Money From? Berl Katznelson Foundation [Hebrew].

7. The public sector proved its weak capabilities in this war, while civil society proved itself very well. Why not invest there instead of the public service?

The discussion on the quality of the public sector is not new and has attracted extensive, in-depth research and policy efforts. At this stage, we believe that the international comparison we present here provides an adequate general picture: most OECD countries provide a significantly greater level of civil and public services than that provided by Israel, and many of them have a richer, stronger economy than we do. In other words, the question is not whether to expand the activity of the public sector, but rather, at what rate and in which fields. The provision of stable, accessible, high-quality civil services cannot rely on volunteers and donations, which are not regular, and it cannot exist only in the fields in which civil society chooses to act. The provision of basic services to all citizens, without discrimination, throughout the entire year, depends on the government and its public budgets. Civil society can and should join this effort, but the full, broad responsibility lies with the government.

Appendix A: The Comparison Countries

Appendix B: Calculation of the budget supplements for the different ministries

The civil expenditure that we used for our calculations includes the regular budget, the development budget and the capital account, and the business enterprise budget (second supplement), all according to the 2023 Budget Law.

We omitted the following sections from these expenses (the relevant budget section appears in brackets):

Defense

Ministry of Defense (15)

Coordination of activities in the territories (17)

Various defense expenses

Atomic Energy Committee (35)

Released Soldiers Law (46)

Debt repayments

Interest payments

Debt payments – general (84), except for payment of debts to the National Insurance Institute.

Israel Lands Authority expenses (98)

We omitted these sections because they are not included in the accepted calculations of civil expenditure. Similarly, we omitted the budget of the Israel Lands Authority, which acts as a business enterprise whose expenses are derived from its revenue, and whose revenue exceeds its total expenditure, in contrast to other enterprises.

We calculated the weight of each field of expenditure in the budget according to these sections of the state budget.

Based on these weights, we divided the budget gap with the OECD countries for 2022 (approximately 171 billion ILS) among the various sections of the State Budget. In other words, we divided the budget supplement according to the state’s existing priorities, as expressed in the 2022 budget.

This calculation method has two limitations:

The state budget does not reflect all of the government’s expenditure. To reflect the total expenditure of the government sector we must base our calculations on the expenditure of the broad government, which also includes the expenditure of local authorities, the National Insurance Institute, and more. However, the broad government expenditure data is not available at the level of detail presented in the state budget. Since our aim is to illustrate magnitude, the existing details in the state budget are more meaningful for understanding under-budgeting than the lack of detail arising from the use of the weights in the state budget.

The current state budget expresses non-optimal priorities, and is partly erroneous. By relying on these priorities, that is, the proportion of the budget allocated to each field, we do not express the optimal budget supplements required for each field since the current gaps are not equal in each field of expenditure. Nevertheless, we have found that despite its limitations, this method capably demonstrates the significance of the change that must be Implemented by the state.

תגובות